"A Conversation with Kenneth Thomas - UMSL Professor of Political Science - 10/23/12"

Wednesday, October 31, 2012

Discussing Tax Increment Financing on TV

I recently appeared on a local public access TV show, "Conversation with Lee Presser," discussing tax increment financing and European Union subsidy control regulations. It's a great format, just an almost 30-minute discussion without interruption, which allowed me to explain the problems with TIF as it has been used in Missouri in great detail. We also had a shorter conversation about EU regulations to control investment incentives and other subsidies, which covered the basics of transparency, maximum subsidy rates that vary by how rich the region is, and the reduction in those rates for large projects. Many thanks to Lee Presser for having me on. If you are interested in economic development issues, I think you will enjoy the program.

"A Conversation with Kenneth Thomas - UMSL Professor of Political Science - 10/23/12"

"A Conversation with Kenneth Thomas - UMSL Professor of Political Science - 10/23/12"

Saturday, October 27, 2012

McMahon's WWE has taken $36.7 million in Connecticut subsidies

U.S. Senate candidate Linda McMahon's World Wrestling Entertainment (WWE) has received $36.7 million in Connecticut film tax credits in 20 separate deals since 2006, reports CTPost.com (thanks to Karin Richmond on the LinkedIn Public Incentives Forum). As in many states, what historically began as tax credits for motion pictures are now available for TV and online media as well, and it is in these two latter categories that the WWE received its subsidies. Also as is typical of other states, the Connecticut program has no job creation requirements, but is calculated simply as a percentage of "qualified expenditures," with the rate being 30% in Connecticut. In fact, in WWE's case, the company had laid off about 60 workers in 2009, yet continued to receive the credits.

Moreover, according to the Sacramento Bee blog, "Cageside Seats," WWE has so little state tax liability that it sells the vast majority of its tax credits via a broker, including 93% of the tax credits it earned in 2007-9. While selling tax credits is perfectly legal (in David Cay Johnston's memorable phrase), it also increases the subsidies that states give, because they wind up giving subsidies to companies that did nothing to qualify for them under any subsidy program.

Nor is WWE alone in its sale of Connecticut tax credits. According to a 2010 article at the CT Post, "of the 80 productions that received credits, only nine applied them to state taxes." The rest, presumably, sold their credits via brokers. The article also states that the national tax credit market had reached $500 million annually in 2010, from $50 million per year in 2005.

Robert Tannenwald of the Center for Budget and Policy Priorities (CBPP) has analyzed state film subsidies and concluded they provide very little bang for the buck. This should not be surprising. Unlike most subsidies, film/TV/digital media subsidies do not go to an investment, but to operating costs. There is nothing left after the crew packs up. Tannenwald points out that even the early adopters of film subsidies (New Mexico and Louisiana), which appeared to have built up some in-state film capacity, are now finding it difficult to maintain their position as the number of states offering such incentives skyrocketed to over 40 by 2010. The increased competition has led states to bid up their reimbursement percentages, to over 40% in Alaska and Michigan. Moreover, it's hard to have job creation requirements for jobs that are inherently temporary.

Tannenwald estimates that the 43 states that gave film tax credits in fiscal 2010 spent $1.5 billion. This is enough to hire back 30,000 state workers laid off since the recession began, at an average of $50,000 per year in salary and benefits.

Although not members of the Forbes 400, Linda and Vince McMahon follow their example in collecting millions in subsidies from government. This is particularly hypocritical since as a Senate candidate McMahon has tried to portray herself as an opponent of "corporate welfare."

Besides having little bang for the buck, film subsidy programs have been rocked by scandal in both Iowa and Louisiana, where the film commissioner was convicted of bribery to accept inflated expense submissions. The Iowa Film Office director was convicted of felonious misconduct, but acquitted on eight other felony charges. A number of credit claimants in Iowa were convicted of felonies as well in other trials.

As I have argued before, investment incentives generally constitute a race to the bottom. However, film and related media subsidies have shown us a high-speed race to the bottom for amazingly little economic benefit. While a few states have cut back on the subsidies due to the recession (and Iowa suspended its program for three years due to the scandal), only federal controls can truly address this problem. My research in Canada (paywalled) found the provinces there similarly unable to control their film subsidy wars. At this point, only transparency in program costs, plus information on the low benefits and frequent scandals, is the only way to generate political pressure for reform.

Moreover, according to the Sacramento Bee blog, "Cageside Seats," WWE has so little state tax liability that it sells the vast majority of its tax credits via a broker, including 93% of the tax credits it earned in 2007-9. While selling tax credits is perfectly legal (in David Cay Johnston's memorable phrase), it also increases the subsidies that states give, because they wind up giving subsidies to companies that did nothing to qualify for them under any subsidy program.

Nor is WWE alone in its sale of Connecticut tax credits. According to a 2010 article at the CT Post, "of the 80 productions that received credits, only nine applied them to state taxes." The rest, presumably, sold their credits via brokers. The article also states that the national tax credit market had reached $500 million annually in 2010, from $50 million per year in 2005.

Robert Tannenwald of the Center for Budget and Policy Priorities (CBPP) has analyzed state film subsidies and concluded they provide very little bang for the buck. This should not be surprising. Unlike most subsidies, film/TV/digital media subsidies do not go to an investment, but to operating costs. There is nothing left after the crew packs up. Tannenwald points out that even the early adopters of film subsidies (New Mexico and Louisiana), which appeared to have built up some in-state film capacity, are now finding it difficult to maintain their position as the number of states offering such incentives skyrocketed to over 40 by 2010. The increased competition has led states to bid up their reimbursement percentages, to over 40% in Alaska and Michigan. Moreover, it's hard to have job creation requirements for jobs that are inherently temporary.

Tannenwald estimates that the 43 states that gave film tax credits in fiscal 2010 spent $1.5 billion. This is enough to hire back 30,000 state workers laid off since the recession began, at an average of $50,000 per year in salary and benefits.

Although not members of the Forbes 400, Linda and Vince McMahon follow their example in collecting millions in subsidies from government. This is particularly hypocritical since as a Senate candidate McMahon has tried to portray herself as an opponent of "corporate welfare."

Besides having little bang for the buck, film subsidy programs have been rocked by scandal in both Iowa and Louisiana, where the film commissioner was convicted of bribery to accept inflated expense submissions. The Iowa Film Office director was convicted of felonious misconduct, but acquitted on eight other felony charges. A number of credit claimants in Iowa were convicted of felonies as well in other trials.

As I have argued before, investment incentives generally constitute a race to the bottom. However, film and related media subsidies have shown us a high-speed race to the bottom for amazingly little economic benefit. While a few states have cut back on the subsidies due to the recession (and Iowa suspended its program for three years due to the scandal), only federal controls can truly address this problem. My research in Canada (paywalled) found the provinces there similarly unable to control their film subsidy wars. At this point, only transparency in program costs, plus information on the low benefits and frequent scandals, is the only way to generate political pressure for reform.

Friday, October 26, 2012

Sunday, October 21, 2012

Starbucks in Hot Water Over British Tax

Reuters (via Tax Research UK) reported on October 15 the results of an extensive investigation into the British unit of coffee giant Starbucks, the second largest restaurant firm in the world after McDonald's. It turns out that the company has reported losing money in every one of the 14 years it has operated in the country, even as it tells investors that the unit is profitable. Reuters documented this latter fact by getting the transcripts of 46 investor conference calls Starbucks has made over the last 12 years.

For the last three years, Starbucks has paid no income tax at all in the United Kingdom. This is a textbook case of using transfer pricing to hide your profits from the taxman and make them show up in tax havens instead.

According to the Reuters report, there are three potential routes the company has to make its profitable British subsidiary legally have no tax liability.

1) The British subsidiary pays a Dutch subsidiary for the use of trademarks and other intellectual property of Starbucks, at a cost of 6% of sales as royalties. An undisclosed amount of this barely profitable unit's revenue is paid to another Starbucks subsidiary in Switzerland. Where the money goes from there only Starbucks and its accountants, Deloitte, know for sure.

2) Starbucks UK buys its beans through another Swiss subsidiary and they are roasted at a second Dutch subsidiary (this may be a pattern: pay a Dutch subsidiary, which pays a Swiss subsidiary). This gives a second opportunity for transfer pricing, although a transfer pricing investigation by Her Majesty's Revenue and Customs (HMRC) in 2009-10 resulted in no penalties, the company told Reuters (HMRC would not comment). However, Richard Murphy reports that HMRC has been cutting audit staff and been subject to regulatory capture by the companies it is supposed to be regulating.

3) Finally, the British subsidiary's operations are financed entirely through debt, for which it pays interest to other Starbucks subsidiaries. The interest is deductible from income in the UK and can accumulate in tax havens as income there. Reuters found that Starbucks UK pays at least 4 percentage points more in interest than McDonald's UK does.

Paying zero corporate income tax (or corporation tax, as they call it in the UK) gives Starbucks a competitive advantage over other coffee companies that are purely domestic and can't get out of the tax. Not surprisingly, this has ignited a firestorm of controversy in the United Kingdom. In the last 6 days, HMRC officials have been summoned for testimony before Parliament, probably in November. The Irish Congress of Trade Unions (which represents unions in Northern Ireland/UK as well as in the Irish Republic) has called for a boycott of Starbucks. And the company's reputation has been simply hammered in the social media there, with studies by YouGov and Buzz showing sharp dips into negative territory on their measures of brand perception.

Of course, if Starbucks goes to all this effort to avoid British taxes, you've got to wonder what strategies it's using to avoid taxes in the United States. Any reporters out there up for the challenge?

For the last three years, Starbucks has paid no income tax at all in the United Kingdom. This is a textbook case of using transfer pricing to hide your profits from the taxman and make them show up in tax havens instead.

According to the Reuters report, there are three potential routes the company has to make its profitable British subsidiary legally have no tax liability.

1) The British subsidiary pays a Dutch subsidiary for the use of trademarks and other intellectual property of Starbucks, at a cost of 6% of sales as royalties. An undisclosed amount of this barely profitable unit's revenue is paid to another Starbucks subsidiary in Switzerland. Where the money goes from there only Starbucks and its accountants, Deloitte, know for sure.

2) Starbucks UK buys its beans through another Swiss subsidiary and they are roasted at a second Dutch subsidiary (this may be a pattern: pay a Dutch subsidiary, which pays a Swiss subsidiary). This gives a second opportunity for transfer pricing, although a transfer pricing investigation by Her Majesty's Revenue and Customs (HMRC) in 2009-10 resulted in no penalties, the company told Reuters (HMRC would not comment). However, Richard Murphy reports that HMRC has been cutting audit staff and been subject to regulatory capture by the companies it is supposed to be regulating.

3) Finally, the British subsidiary's operations are financed entirely through debt, for which it pays interest to other Starbucks subsidiaries. The interest is deductible from income in the UK and can accumulate in tax havens as income there. Reuters found that Starbucks UK pays at least 4 percentage points more in interest than McDonald's UK does.

Paying zero corporate income tax (or corporation tax, as they call it in the UK) gives Starbucks a competitive advantage over other coffee companies that are purely domestic and can't get out of the tax. Not surprisingly, this has ignited a firestorm of controversy in the United Kingdom. In the last 6 days, HMRC officials have been summoned for testimony before Parliament, probably in November. The Irish Congress of Trade Unions (which represents unions in Northern Ireland/UK as well as in the Irish Republic) has called for a boycott of Starbucks. And the company's reputation has been simply hammered in the social media there, with studies by YouGov and Buzz showing sharp dips into negative territory on their measures of brand perception.

Of course, if Starbucks goes to all this effort to avoid British taxes, you've got to wonder what strategies it's using to avoid taxes in the United States. Any reporters out there up for the challenge?

Friday, October 19, 2012

Romney's Accountants Busted in New Tax Justice Network Study

When Mitt Romney released the second of his tax returns last month, he also gave us a summary of his 1990-2009 taxes prepared by his accounting firm, PricewaterhouseCoopers (PwC). The whole point of that exercise, aside from trying to distract people from demanding the actual returns, was to muddy the waters and hide behind the supposedly strong reputation of PwC: an accounting firm would never lie, would it?

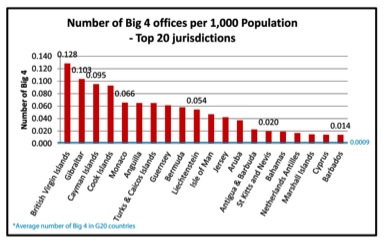

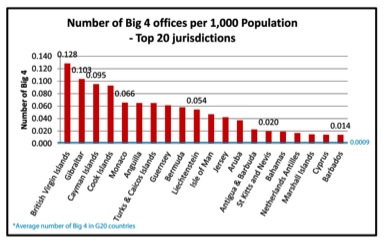

Of course, this is a silly question on its face. Who do you think designs abusive tax shelters, other than tax accountants and tax attorneys? Now, in a new study by the Tax Justice Network, we see that there is a positive correlation between a jurisdiction's (remember, not all tax havens are independent countries) secrecy index and the number of banks and Big Four accounting firms (PwC, Ernst & Young, KPMG, and Deloitte) per capita present there. The report documents one "leveraged partnership transaction" that PwC both designed and then pronounced to be legally valid (in what is usually termed an "opinion," for which it was paid $800,000), which the U.S. Tax Court strongly criticized as a "conflict of interest" when it upheld the Internal Revenue Service's squashing of this arrangement.

More specifically, we find that the Cayman Islands had the third most Big Four accounting offices per 1000 population at 0.95, compared with just .001 per 1000 for the United States (see Graphs 4 and 5, p. 24, in the report). This density is almost 100 times higher in the Caymans than in the U.S. The Caymans also had more than twice as many banks per 1000 as any other country, at 4.5 per 1000, compared to .023 per 1000 for the U.S. (Graphs 1 and 2). The graph below shows Big Four offices per 1000:

Source: Tax Research UK

Note, too, that Bermuda (which the Romneys also have used) comes in at about .06 per 1000 population, or about 60 times the U.S. rate.

Similarly, we find that comparing the secrecy score of the 20 worst tax havens with the Tax Justice Network's broader list of 71 tax havens and with the G-20 nations shows a much higher mean and median secrecy score in the tax havens than in the non-havens, as the next graph shows.

Source: Tax Research UK

As Richard Murphy, one of the authors of the report, comments at Tax Research UK:

This, then, is the world in which Mitt Romney travels, a world in which accounting firms actively seek to create tax avoidance opportunities with little concern for whether they step outside the law's boundaries, and in so doing facilitate the transfer of the tax burden from the 1% to the 99%. In my opinion, PwC's assurances about Romney's tax situation are not worth the paper they're printed on.

Bonus question for President Obama to pose in the third debate: Why is the "McCain precedent" (2 years of tax returns) more important to you than the George Romney precedent (12 years of returns)?

Of course, this is a silly question on its face. Who do you think designs abusive tax shelters, other than tax accountants and tax attorneys? Now, in a new study by the Tax Justice Network, we see that there is a positive correlation between a jurisdiction's (remember, not all tax havens are independent countries) secrecy index and the number of banks and Big Four accounting firms (PwC, Ernst & Young, KPMG, and Deloitte) per capita present there. The report documents one "leveraged partnership transaction" that PwC both designed and then pronounced to be legally valid (in what is usually termed an "opinion," for which it was paid $800,000), which the U.S. Tax Court strongly criticized as a "conflict of interest" when it upheld the Internal Revenue Service's squashing of this arrangement.

More specifically, we find that the Cayman Islands had the third most Big Four accounting offices per 1000 population at 0.95, compared with just .001 per 1000 for the United States (see Graphs 4 and 5, p. 24, in the report). This density is almost 100 times higher in the Caymans than in the U.S. The Caymans also had more than twice as many banks per 1000 as any other country, at 4.5 per 1000, compared to .023 per 1000 for the U.S. (Graphs 1 and 2). The graph below shows Big Four offices per 1000:

Source: Tax Research UK

Note, too, that Bermuda (which the Romneys also have used) comes in at about .06 per 1000 population, or about 60 times the U.S. rate.

Similarly, we find that comparing the secrecy score of the 20 worst tax havens with the Tax Justice Network's broader list of 71 tax havens and with the G-20 nations shows a much higher mean and median secrecy score in the tax havens than in the non-havens, as the next graph shows.

Source: Tax Research UK

As Richard Murphy, one of the authors of the report, comments at Tax Research UK:

This research lets us conclude that working in conditions of secrecy has

become an inherent part of the work of bankers and accountants. It

suggests that this has led to a culture of creative non-compliance with

laws and regulations, which is likely to increase the potential for, and

volume of, crime. At the same time, banks’ and Big 4 firms’ lobbying

for laws and regulations that reduce transparency is likely to have

resulted in further opacity in the world’s financial system.

This, then, is the world in which Mitt Romney travels, a world in which accounting firms actively seek to create tax avoidance opportunities with little concern for whether they step outside the law's boundaries, and in so doing facilitate the transfer of the tax burden from the 1% to the 99%. In my opinion, PwC's assurances about Romney's tax situation are not worth the paper they're printed on.

Bonus question for President Obama to pose in the third debate: Why is the "McCain precedent" (2 years of tax returns) more important to you than the George Romney precedent (12 years of returns)?

Wednesday, October 17, 2012

Fortune 500 Deferring $433 Billion in Taxes

According to a new report today from Citizens for Tax Justice, the 285 members of the Fortune 500 that have parked money overseas would owe an estimated $433 billion in taxes if and when it is repatriated. No wonder these companies are working so hard to get a "repatriation holiday" even though the one given in 2004 did not yield any significant new investment, but lots of dividends and stock buybacks.

The new report list 10 companies with $209 billion parked overseas that report the taxes they would owe on these profits (only 47 do so). These companies all report that they would owe 32-35% on their money, which indicates they have not paid any taxes abroad on it; in other words, the money is in tax havens.

Note that some estimates place these figures even higher; in March, I reported that Apple's overseas stash was estimated at $64 billion.

Based on the entire 47 companies that report their estimated tax bill, CTJ came up with an average tax rate of just over 27%. Multiplied by the $1.584 trillion in overseas cash held by the 285 corporations (up from about $1 trillion estimated in March) yields the figure of $433 billion in taxes that would be due if the income were repatriated or the deferral provision for overseas income ended.

What does it all mean? As U.S. companies continue to enjoy record profits, they are declaring them to be foreign profits at a high rate, as we can see in the increase from the March to October estimates. Numerous tech and financial companies have stashed literally tens of billions of dollars, each, in offshore tax havens, which drain billions a year from tax coffers that must be made up with higher taxes on the middle class, larger budget deficits, or cuts in programs. And as we have seen from the two tax returns Mitt Romney has released, there is one tax system for the 1% and another one for the rest of us.

The new report list 10 companies with $209 billion parked overseas that report the taxes they would owe on these profits (only 47 do so). These companies all report that they would owe 32-35% on their money, which indicates they have not paid any taxes abroad on it; in other words, the money is in tax havens.

Note that some estimates place these figures even higher; in March, I reported that Apple's overseas stash was estimated at $64 billion.

Based on the entire 47 companies that report their estimated tax bill, CTJ came up with an average tax rate of just over 27%. Multiplied by the $1.584 trillion in overseas cash held by the 285 corporations (up from about $1 trillion estimated in March) yields the figure of $433 billion in taxes that would be due if the income were repatriated or the deferral provision for overseas income ended.

What does it all mean? As U.S. companies continue to enjoy record profits, they are declaring them to be foreign profits at a high rate, as we can see in the increase from the March to October estimates. Numerous tech and financial companies have stashed literally tens of billions of dollars, each, in offshore tax havens, which drain billions a year from tax coffers that must be made up with higher taxes on the middle class, larger budget deficits, or cuts in programs. And as we have seen from the two tax returns Mitt Romney has released, there is one tax system for the 1% and another one for the rest of us.

Monday, October 15, 2012

The Folly of Subsidizing Retail

Next to giving subsidies for a company to relocate, or to prevent it from locating, the lease defensible common use of investment incentives is for retail. Why should this be? Let me count the ways.

Most importantly, retail is a derivative economic activity, as David Cay Johnston says. A location's population and income determine how much retail it can support. For this reason, the apparent job creation of retail subsidies is completely phantom, as sales and jobs are simply transferred from older stores to newer locations. The best proof of this is contained in a groundbreaking study by the East-West Gateway Council of Governments, the regional planning agency of the St. Louis metropolitan area.

East-West Gateway's study found that from 1990 to 2007 (i.e., before the financial crisis), the over 100 local governments of the St. Louis metro area had collectively provided over $2 billion in subsidies for malls and other retail facilities. Most of this was in the form of tax increment financing, a popular local subsidy tool in both Missouri (to the tune of $339 million annual average from 2004 to 2006; see p. 7 in the source) and Illinois. Yet, by the end of this 17 year period, there were only 5400 more retail jobs in the metro area than at the beginning. This would total $370,370 per job if the jobs were created by the subsidies; however, it is more likely that they are simply due to income growth in the region. (Note to reporters: This would be a great study to replicate in your area.)

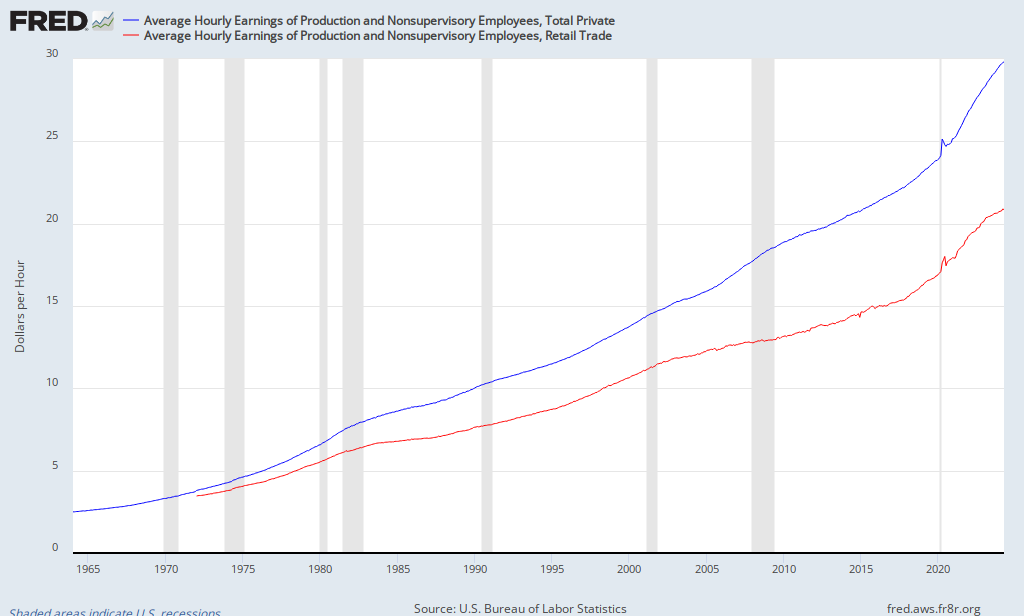

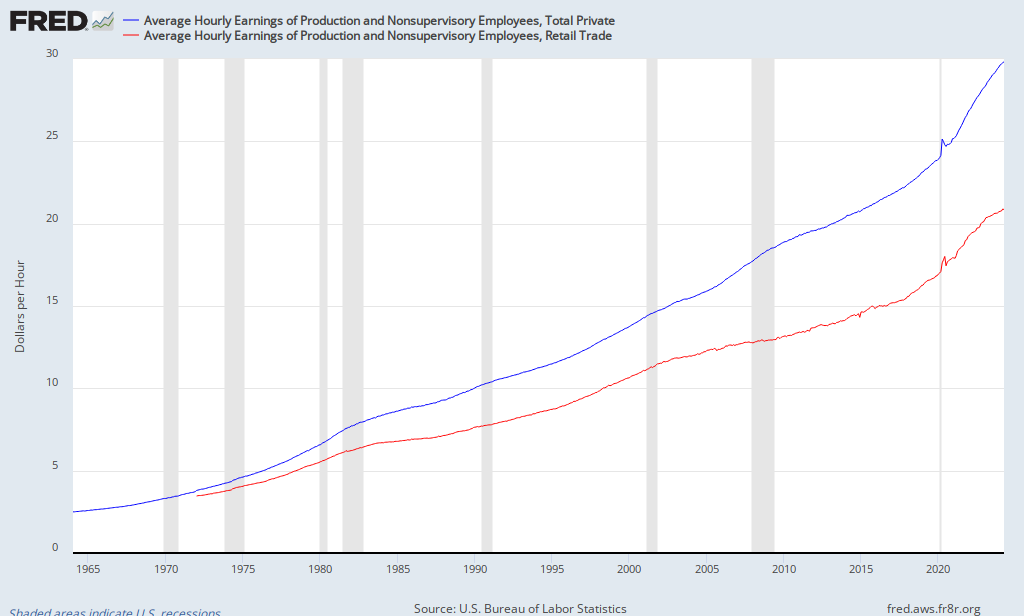

Second, retail jobs are not all that good. Here is a custom graph from FRED showing the nominal wage trend for all production and non-supervisory workers (blue) and for production and nonsupervisory workers in retail (red). As you can see, the wage gap has been increasing for 40 years. As of September, the exact figures were $13.86/hr. for retail vs. $19.81/hr. for all private industries. Moreover, given that the overall total as shown in the graph actually represents a decline in real wages, the decline in retail is much more pronounced.

In addition to the low pay, retail workers rarely get benefits. According to a new report, only 29% of retail workers get health care benefits, even though half of retail employees have college degrees and 70% are over age 24.

Third, retail does not generate much secondary employment, the way manufacturing does. It does require warehouse jobs, but those generally get subsidized, too, as in the case of Wal-Mart.

The bottom line, then, is simple. Retail is a derivative economic activity that generates almost no new spinoff activity, and local governments (except perhaps in poor areas with food deserts) should not subsidize it. As we have seen in St. Louis, local governments have proven perfectly capable of wasting billions of dollars for temporary gains in sales tax revenues. It's time to stop the madness.

Most importantly, retail is a derivative economic activity, as David Cay Johnston says. A location's population and income determine how much retail it can support. For this reason, the apparent job creation of retail subsidies is completely phantom, as sales and jobs are simply transferred from older stores to newer locations. The best proof of this is contained in a groundbreaking study by the East-West Gateway Council of Governments, the regional planning agency of the St. Louis metropolitan area.

East-West Gateway's study found that from 1990 to 2007 (i.e., before the financial crisis), the over 100 local governments of the St. Louis metro area had collectively provided over $2 billion in subsidies for malls and other retail facilities. Most of this was in the form of tax increment financing, a popular local subsidy tool in both Missouri (to the tune of $339 million annual average from 2004 to 2006; see p. 7 in the source) and Illinois. Yet, by the end of this 17 year period, there were only 5400 more retail jobs in the metro area than at the beginning. This would total $370,370 per job if the jobs were created by the subsidies; however, it is more likely that they are simply due to income growth in the region. (Note to reporters: This would be a great study to replicate in your area.)

Second, retail jobs are not all that good. Here is a custom graph from FRED showing the nominal wage trend for all production and non-supervisory workers (blue) and for production and nonsupervisory workers in retail (red). As you can see, the wage gap has been increasing for 40 years. As of September, the exact figures were $13.86/hr. for retail vs. $19.81/hr. for all private industries. Moreover, given that the overall total as shown in the graph actually represents a decline in real wages, the decline in retail is much more pronounced.

In addition to the low pay, retail workers rarely get benefits. According to a new report, only 29% of retail workers get health care benefits, even though half of retail employees have college degrees and 70% are over age 24.

Third, retail does not generate much secondary employment, the way manufacturing does. It does require warehouse jobs, but those generally get subsidized, too, as in the case of Wal-Mart.

The bottom line, then, is simple. Retail is a derivative economic activity that generates almost no new spinoff activity, and local governments (except perhaps in poor areas with food deserts) should not subsidize it. As we have seen in St. Louis, local governments have proven perfectly capable of wasting billions of dollars for temporary gains in sales tax revenues. It's time to stop the madness.

Subscribe to:

Posts (Atom)